Pa|

For Bold Technical Founders Building the Autonomous Enterprise

Before you build your team, before you write your first line of code, before you even take your first check—that’s when boldstart gets to work. We collaborate with technical founders well before company creation, lead pre-product rounds at Inception, and rally our early adopter network to help turn bold ideas into category-creating iconic companies.

From AI-native infrastructure, security, apps, and models, we back the builders reimagining how businesses operate.

We’ve been in the trenches with Snyk, Clay, Protect AI, CrewAI, Tessl, Generalist AI, Stealth (bio model) and so many more from Inception.

The Latest

Announcing boldstart Fund VII: Inception Reloaded — $250M to Build the Autonomous Enterprise »

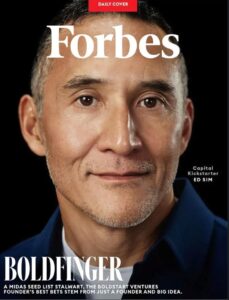

Ed Sim selected to Forbes Midas Seed List for 4th Year! »

Ed Sim selected to Forbes Midas Seed List for 4th Year! »

Ed Sim on the Carta Podcast: Backing Founders From Day Zero »

From Inception to AI security leader – ProtectAI’s journey to exit to Palo Alto Networks »

Boldstart & SVB Inception Bootcamp »

boldstart technical founder summit — AI giveth and AI taketh away + other  learnings »

learnings »

Clay boosts valuation to $1.3 billion – “a secret weapon for Anthropic and OpenAI” »

Baz – Your AI Code Review Agent – Welcome to boldstart! »

Grepr – Next Generation Reliability Platform for an AI-Powered World – Welcome to boldstart! »

boldstart 2024 recap »

Welcome Ron Miller, our new Operating Partner and Head of Editorial, FastForward Launch Day »

Turpentine VC: E66: Why Inception Investing Beats Traditional Seed with Ed Sim of Boldstart Ventures »

Tessl worth a reported $750 million after latest $100 million funding to help it build ‘AI native’ software development platform (Fortune) »

Snyk Code’s $100 Million Milestone: AI-Driven Growth (Forbes) »

Web3 security firm Hypernative raises $16 million in Series A funding (The Block) »

CXOTalk: Ed Sim + Investing in Early Stage Enterprise AI »

Driving Alpha Podcast: Inception investing in technical enterprise founders with Ed Sim »

Ed shares 28 years of lessons as an enterprise inception investor on The Peel Podcast »

Forbes Cover Story on Ed for Midas Seed List 2024 »

The Midas Seed List 2024: Congrats Ed on 3rd Annual Top 10 ranking of Top 25 Seed Investors worldwide »

Congrats Ed for #1 on “The Seed 100: The best early-stage investors of 2024” for 2nd year »

20VC: The Three Types of Seed Rounds (aka “Inception Rounds”), Why Seed Has Never Been More Competitive… »

Ed Sim got into VC by answering a newspaper ad. Today he’s the industry’s No. 1 seed investor (Insider). »

There’s not just one playbook.

Getting from idea to Series A is a tangled path. There’s no prescription. You need a true believer in what you are doing, to help you figure out what’s next and be with you when it’s hard to see the path ahead. That’s what boldstart does, and we’ve done it repeatedly for more than 10 years now.

07.01.2025

Superhuman: Superhuman is acquired by Grammarly

08.04.2021

Superhuman: $75M Series C led by IVP

Read more about Superhuman »

06.17.2025

Generalist: Generalist emerges from stealth, sharing research preview with the world

03.21.2024

Generalist: boldstart partners with Generalist AI, leading the inception round

Read more about Generalist »

06.10.2025

CloudQuery: $16M follow on round led by Partech with existing investors from boldstart, Tiger Global, and Work-Bench participating (VentureBeat)

06.22.2022

CloudQuery: $15M Series A led by Tiger Global. More on our follow on investment and day one partnership.

Read more about CloudQuery »

06.10.2025

Hypernative: Announced $40M Series B co-led by Ten Eleven Ventures and Ballistic Ventures, with participation from StepStone Group, and existing investors boldstart ventures and IBI Tech Fund

09.03.2024

Hypernative: Announced $16M Series A Round (company post) including strategic partner Quantstamp + existing investors boldstart ventures, IBI Tech Fund, CMT Digital, Bloccelerate, and Borderless to expand into new verticals and build a Web3 security network (more from The Block)

Read more about Hypernative »

04.28.2025

Protect AI: Protect AI has been acquired by Palo Alto Networks to secure enterprise AI end-to-end - read the story from Inception to category creation to exit here

07.26.2023

Protect AI: Announced $35M Series A round (TechCrunch) led by Evolution Equity w/Salesforce Ventures

Read more about Protect AI »

04.22.2025

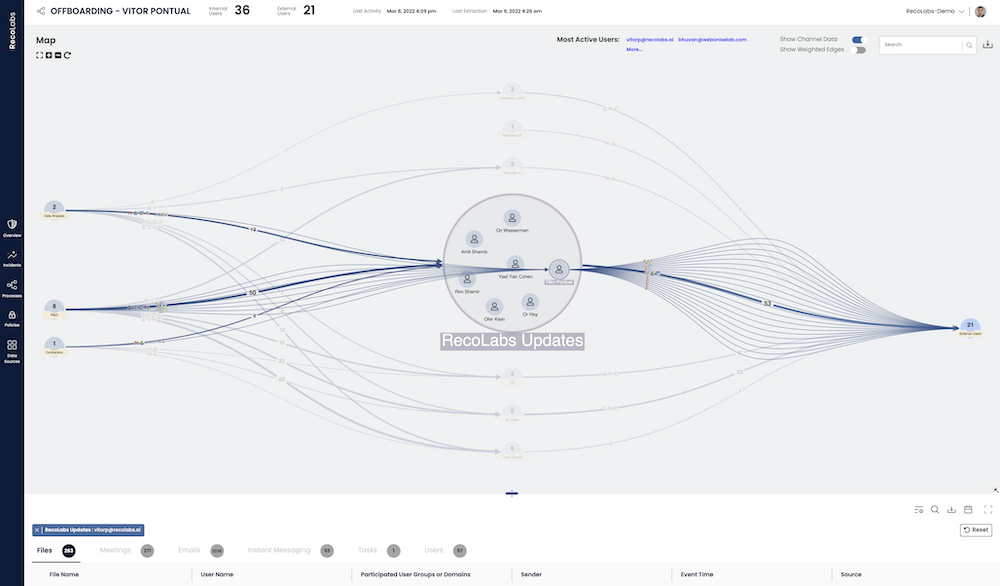

Reco: $25M additional funding round from existing investors Insight Partners, Zeev, boldstart, and Angular participating along with new investor RedSeed (Business Insider)

06.03.2022

Reco:

Read more about Reco »